Alaska Trends

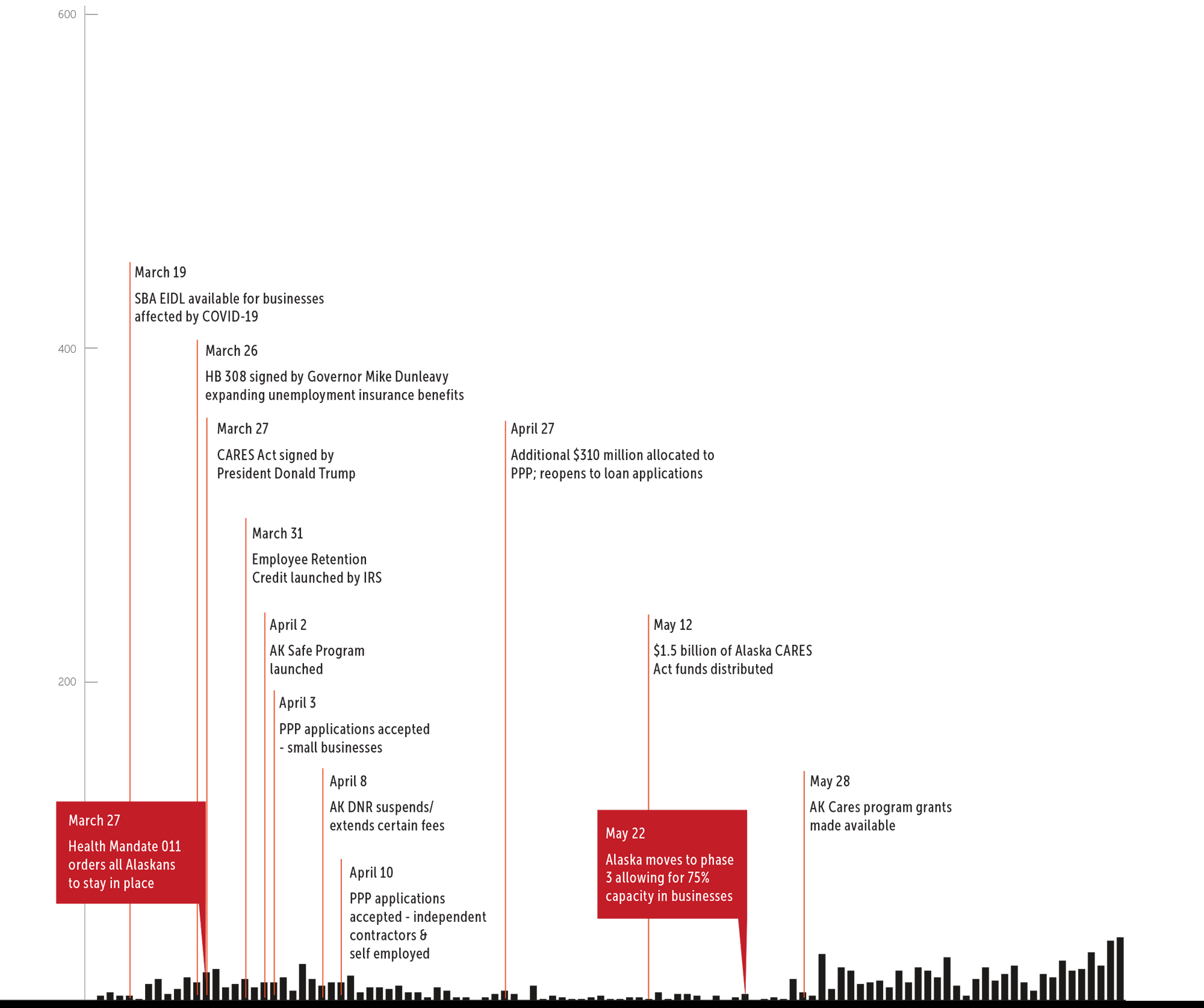

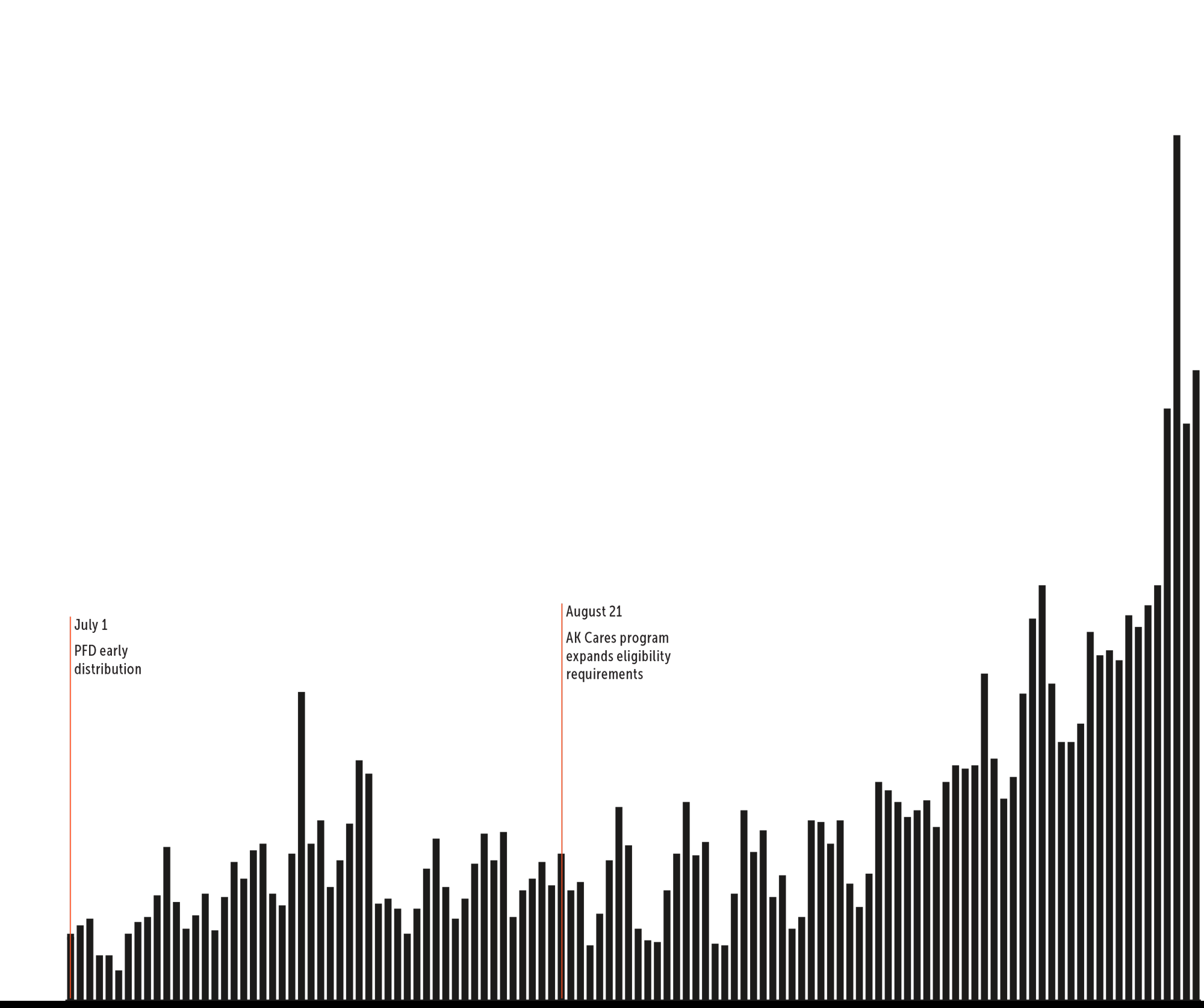

he impacts of COVID-19 on Alaska’s economy are myriad, and the combined action plans of federal and state governments in responding to the pandemic have been equally multifaceted. Loan forgiveness programs, relief activity, and early permanent fund dividend distribution are a few of the tactics that government officials employed to keep Alaska’s economy running.

Staying abreast of what’s happening during the pandemic—case numbers, statewide health mandates, unemployment statistics—is a daunting task. This month in Alaska Trends we provide an overview of a few key statistics and COVID-19 response efforts. While much of the information is unsettling, there are some positive spots to consider. For example, compared to the beginning of the pandemic, current unemployment numbers have almost been cut in half. And what we can’t see in this data is the incredibly hard work going on behind the scenes to both secure economic opportunities and safeguard the health of every Alaskan.