ig things are in store for Alaska’s biggest crude oil producer. ConocoPhillips Alaska, Inc. announced last year that it intends to continue pumping $1 billion per year into its legacy projects in the state while also pursuing new projects. With 1.2 million net undeveloped acres as of the end of 2022, ConocoPhillips Alaska is the largest owner of exploration leases.

“When I think about this track record of adding new development, ConocoPhillips Alaska has more than fifty years of experience on the North Slope safely exploring and discovering new resources and developing new projects and also being a trusted partner for the state in creating wealth for the communities,” says Vincent Lelarge, vice president of Alaska asset development. “With the people and the technology and the skills we have—and with a stable fiscal environment—we have the potential to continue this trend of value creation for decades.”

And that’s good for the state, says Kara Moriarty, president and CEO of the Alaska Oil and Gas Association. “From our perspective, anytime you have a company making major investments in Alaska, it continues the long-term viability of our industry and for us that’s our main mission,” she says.

Altogether, oil and gas companies provided $4.5 billion in state and local revenue in 2022 and supported more than 69,000 direct and indirect jobs in Alaska. That year was significantly buoyed by one new ConocoPhillips Alaska project, Greater Mooses Tooth 2 (GMT2), which hints at the potential contained in the planned Nuna and Willow developments.

The company’s Alaska presence, however, owes a lot to California-based Richfield Oil, which discovered the first commercially successful field at Swanson River on the Kenai Peninsula in 1957. After merging with Atlantic Refining Company to become ARCO, the next historic discovery was in 1968 at Prudhoe Bay. Fifteen years later, ARCO opened its new Alaska headquarters in a twenty-two-story tower in downtown Anchorage.

Fifteen years after that, BP was the major player in Alaska’s Oil Patch, growing even larger by taking over Amoco. That merger, the biggest at the time, prompted caution in 2000 when BP set its sights on ARCO, too. Federal regulators required BP to divest ARCO Alaska and its North Slope pipeline entities to a competitor, Phillips Petroleum. The “Phillips 66” logo adorned the ARCO Tower for two years before Conoco merged with the company in 2002.

Phillips Petroleum had ventured into Alaska by itself in the ‘60s, exploring some North Slope leases prior to the Prudhoe Bay discovery, building the Kenai liquified natural gas plant with Marathon Oil, and drilling in the North Cook Inlet Unit. Hilcorp took over the unit’s Tyonek platform in 2016, not long before acquiring vastly more assets during BP’s departure from the state. The handover included BP’s interest in the Milne Point Unit on the North Slope, put into production by Conoco in 1985. ConocoPhillips Alaska retained a Cook Inlet presence at the Beluga River natural gas field until selling its stake to Chugach Electric Association, in partnership with the Municipality of Anchorage.

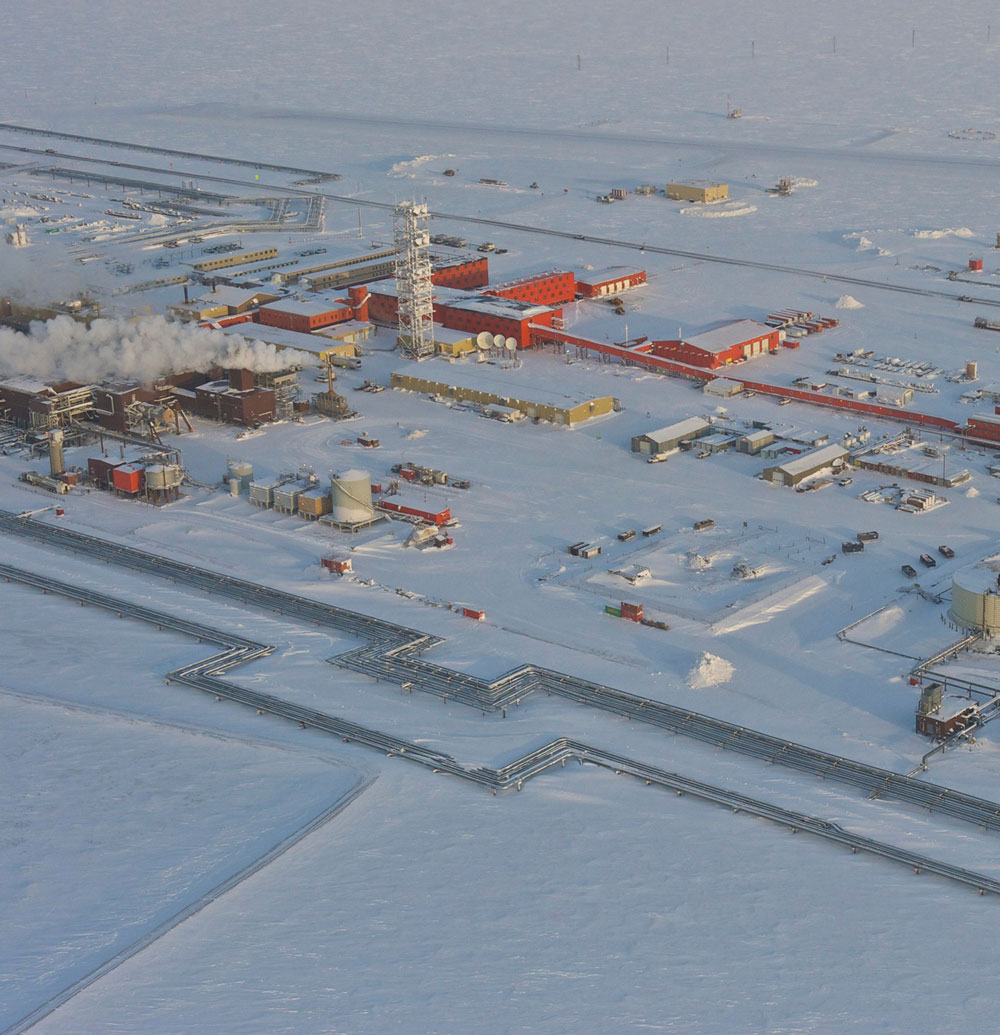

That leaves ConocoPhillips Alaska’s 1,000 employees busy on the North Slope operating the Kuparuk River Unit (KRU), the continent’s second-largest oil field next to Prudhoe Bay. Farther west, the company also developed the Colville River Unit, site of the Alpine oil field. From those facilities, ConocoPhillips Alaska was able to push westward into federal lands, the National Petroleum Reserve Alaska (NPR-A), producing first oil from the Greater Mooses Tooth satellite field in 2018.

GMT2 is expected to produce approximately 140 million barrels of oil over the life of the field. GMT2 facilities include a 14-acre drilling pad, 8 miles of gravel road, and pipelines connected to Colville River Unit infrastructure. During construction, the project created approximately 700 jobs.

The site produces royalties for both the federal government and Arctic Slope Regional Corporation, with half of the federal royalties put into the NPR-A development fund for distribution to nearby communities. GMT2 was designed to minimize environmental impact and won the Alaska Oil and Gas Award for Environmental Stewardship shortly after first oil was achieved in December 2021, under budget and on schedule.

“GMT2 has eighteen wells drilled and completed to date, and the GMT unit is producing about 14,000 barrels per day, net after royalties,” says Lelarge. “We have five more wells we’ll be drilling and completing in 2024, and additional drilling potential is still being assessed and evaluated for 2025 and beyond.”

“Nuna is another exciting major project in one of our legacy assets,” says Lelarge. “What is remarkable with this project is the way it is continuing to build upon existing infrastructure and plugging it into the existing processing facilities.”

ConocoPhillips

Nuna would join the other KRU fields, such as Tarn, West Sak, Meltwater, and Tabasco. More than 500 wells in KRU have produced more than 2.5 billion barrels of oil so far.

Plans for Nuna call for approximately twenty-nine wells, an extension of the existing pad, on-pad infrastructure, and pipelines tied back to KRU processing facilities. Nuna will be the forty-ninth drill site developed within the KRU.

“This is really a great project for the local community, as well,” says Lelarge. “There is a single production module which includes all of the essentials of production facilities, and it’s being fabricated in Anchorage with local labor and will be transported from the Port of Anchorage to the North Slope—the first single production module like this fabricated in Alaska in more than two decades.”

Construction began in 2023 and continues in 2024 with the pipeline and on-pad construction. Drilling is expected to start late this year, with first oil anticipated by early 2025. ConocoPhillips Alaska anticipates a peak rate of 20,000 barrels per day.

Lelarge says, “It’s pretty exciting to see this kind of work being done in Alaska, and it’s a great opportunity for the local economy. The way we think about this is that Nuna is another example of ConocoPhillips continuing to invest in Alaska and leveraging current infrastructure and using local labor.”

ConocoPhillips

ConocoPhillips Alaska acquired the Willow leases in 1999, and after successful exploration, the permitting process began in 2018. The project underwent five years of regulatory review and environmental analysis as well as more than 215 days of public comment and twenty-five in-person public meetings in Anchorage, Fairbanks, Nuiqsut, Utqiaġvik, Atqasuk, and Anaktuvuk Pass. In December 2023, ConocoPhillips Alaska announced a final investment decision, approving the Willow project and funding construction.

Willow is expected to cost $7 billion to $7.5 billion to develop from 2024 to first oil, which is expected in 2029. Over its lifetime, Willow is expected to produce about 600 million barrels of oil, or about four GMT2s. “It’s the largest project in size and scale to be developed on the North Slope in more than twenty years,” says Lelarge.

Construction on the Willow project began last year during the 2023 ice road season, and it continues this year, according to Lelarge, who says significant progress should be made in 2024, including the gravel road, pad, and pipeline construction. “We expect the operations center will be delivered in 2024, and the workload for Willow should remain steady for the next few years as we prepare for first oil in 2029,” he says.

“That’s the track record we have of adding new projects,” he says. “Development projects like Willow and Nuna and the other projects I mentioned really stimulate the economic growth in Alaska and generate taxes and revenue for state and local governments, and they contribute to strengthening our energy security in the country.”

ConocoPhillips Alaska is somewhat unique, advancing new development on federal lands. Opening the oil frontier in NPR-A entails grappling with decision-making priorities in Washington, DC, that are different from the state government.

Moriarty recognizes that ConocoPhillips Alaska has had to struggle getting federal approval. “So it’s really rejuvenating to see contractors busier than they’ve been in some time,” she says. “It’s not only good for the industry but for the state and the local government of the North Slope Borough.” Moriarty notes that Santos and Hilcorp are also contributing to a recovery after the oil price crash of 2014 stalled investments.

Every oil and gas industry job supports fifteen additional jobs in Alaska, according to a study by McKinley Research Group. Pointing to that study, Lelarge says, “Our industry and all of the activity on the North Slope continue to be a dominant generator to the economic activity in Alaska. New projects like these assure us that the state of Alaska has a viable economic future.”