FINANCE

Convenient and Brick-Free

How technology

changed banking

By Tracy Barbour

Denali State Bank’s

main office in Fairbanks.

Denali State Bank

inancial institutions have been consistently building up their virtual banking services to better accommodate their customers. Virtual banking—often referred to as online banking or electronic banking—is essentially the equivalent of traditional banking over the internet. It allows customers to access their account digitally 24/7 to transfer funds, pay bills, and apply for loans from the comfort of their home, office, or anywhere, really. And with the prevalence of smart devices, mobile banking is becoming an expected service among consumers.

A Hybrid Approach

Most financial institutions in Alaska use a hybrid model that blends traditional store-front operations with virtual or online components. That’s exactly what’s happening at First National Bank Alaska. Generally, customers expect and are migrating to digital service offerings. As a result, First National is investing in the “digital frontier,” says Phil Griffin, executive vice president and chief information officer. However, the bank is also focused on enhancing its branches. “Even in the digital world, customers are using more mobile devices than traditional PCs,” Griffin says. “So it is important to have mobile friendly digital offerings. Nevertheless, the brick-and-mortar branch is still alive and well. As an institution, we are evaluating different ways to enhance the branch experience.”

Northrim Bank is taking a similar approach, augmenting its internet-based services in a number of ways. Examples include the enhancements made to its Business Online Banking product, the recent implementation of its Account Recon and Positive Pay product, and its Business Mobile app. However, it’s not entirely clear how customers are leveraging these options. “We don’t have good insight into whether our customers are working in virtual environments as our Business Online Banking services are compatible with both environments,” says Katie Bates, senior vice president and director of electronic channels.

What is clear, Bates says, is that customers are steadily reaching for virtual services. Volumes in Northrim’s electronic channels continue to increase, and the bank is working hard to ensure its electronic products and services allow commercial customers to self-serve when that option is best for their business. “We continue to offer and expand our branch network to support customers, as there are some businesses that need and like personal attention,” she says.

KeyBank is also making enhancements in several areas. In anticipation of evolving banking preferences, KeyBank expanded and improved its online and mobile banking capabilities over the past several years. According to Alaska Market Leader Lori McCaffrey, the bank is providing clients with an easy-to-use, secure way to manage their money—whether it’s by accessing their accounts via mobile or online, using Bill Pay or Zelle to schedule or make payments, or accessing the bank’s HelloWallet financial wellness tool.

McCaffrey says KeyBank wants banking to be easy and for its clients to be able to bank when and how they choose. Offering a variety of banking methods makes this more feasible. “We don’t see online and mobile banking and brick-and-mortar banking to be mutually exclusive,” she says. “In fact, our financial wellness strategy combines the benefits of high tech—a digital personal finance management tool—with high touch, encouraging clients to visit a convenient branch to review their financial wellness plan with a banker.”

Denali State Bank is expanding some of its existing virtual banking services, too. The bank is currently revamping its website to make it more user-friendly. And next year it’s adding a consumer loan product that features more automated processes. The bank’s mortgage and consumer loan applicants can already apply online, but the upcoming enhancements will make their experience even more convenient. “Most of our customers do not have to come to the bank for any reason for their loan,” says President and CEO Steve Lundgren.

Customers of Denali State Bank can take advantage of online banking services in a number of other ways. They can receive their statements electronically and view their balance online through the bank’s website or its mobile banking app. They can also initiate payments and monitor account activities through the secure app. “We continue to upgrade our mobile app about once a year,” Lundgren says. “It is fully functional.”

Steve Lundgren, President and CEO, Denali State Bank

Denali State Bank

Boosting Virtual Solutions

Credit Union 1 is continually evaluating and adding products to help customers—referred to as members—easily manage their accounts from a handy mobile device. Its approach to growing its virtual presence is to make the services it offers in-branch also available online. “We’re always looking for ways to improve members’ experience so that it’s consistent, reliable, and streamlined,” explains Vice President of E-Services Tyler Hasbrouck.

The credit union wants to meet members where they want to be met, Hasbrouck says. There has been a shift over the last couple of years where members prefer to conduct inquiries via a desktop computer and mobile device rather than in person. “Because of this shift, we want to provide as many of the same services that they’d receive in person through electronic means,” he says. “Banking shouldn’t be hard, and by removing as much friction as possible and giving our members the tools to manage their finances from home or on the road, we’re doing exactly that.”

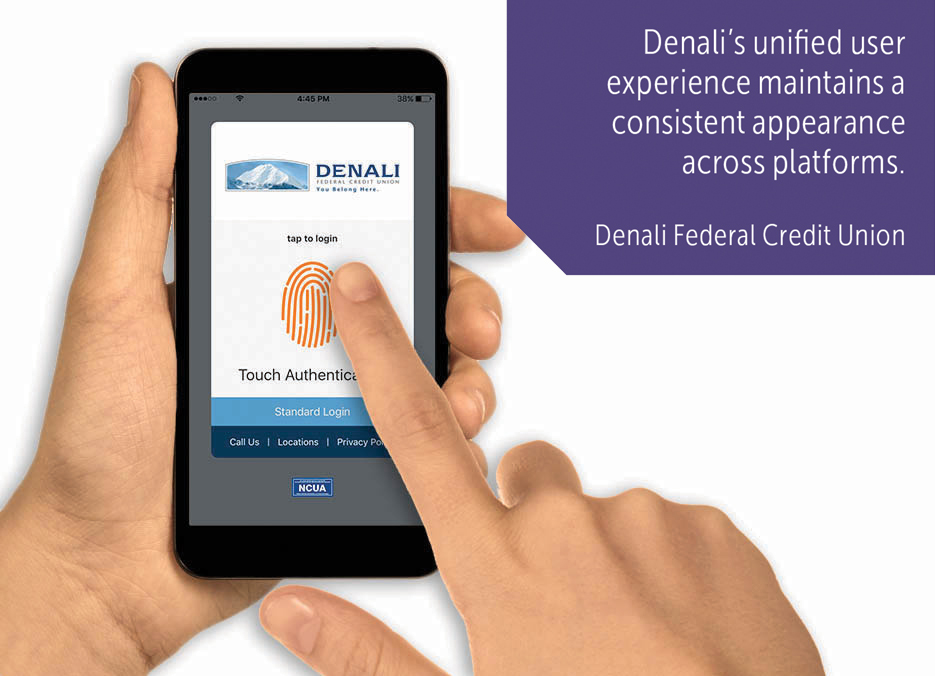

Denali Federal Credit Union, a division of Nuvision Credit Union, has a comparable perspective. Its members can do virtually all of their banking online, whether it’s accessing their account, applying for a loan, or depositing checks. And if they have questions, they can message a member service representative through Denali’s secure app and get specific account details and other personal information. “They can pretty much do all of their banking needs through the app,” says Gracia O’Connell, vice president of call center operations and eServices. “Really, the focus is we want members to be able to use this for all of their banking needs.”

Denali is also focused on mobile-first technology that allows members to have functionality across devices. “It can be a primary experience on your mobile device,” O’Connell says.

“Supplementary online services… carry a big potential to display content to members that is uniquely relevant to them, as opposed to spamming people with information that doesn’t apply to them or their situation.”

—Tyler Hasbrouck, Vice President of E-Services, Credit Union 1

Credit Union 1

Business owners can use Denali’s products to complete transactions online—from wire transfers to remote deposit checks to ACH payroll—or delegate them to a trusted third party. For example, they could designate a CPA to handle all of their major business transactions virtually but maintain the ability to see everything that’s done.

To facilitate online banking, Denali offers a unified user experience. UUX, as it’s called, allows members to have a very similar look to their online experience, whether they’re using a mobile phone or tablet. “When you do that, it gives the members a comfort level and an ease of using multiple platforms to get to where they need,” says Keith Fernandez, vice president of corporate communications and development. “The new UUX has been a key to us. About three years ago, we had about 29,000 members. Less than three years later, we now have about 41,000.”

Demand Drives Virtual Services

Financial institutions have various reasons for beefing up their virtual banking services. For example, Denali State Bank is driven by customer demand for online and mobile banking services.

“We have a certain segment of our customer base that asks for those products and services,” Lundgren says. “In order to remain competitive, we want to offer them.”

Offering virtual banking services allows Denali State Bank to cater to Alaska’s transient residents. Plus, new customers of the bank prefer these types of products and services.

Denali Federal Credit Union agrees. With the transient nature of many Alaskans, the credit union’s membership base includes snow birds (who reside in the state half of the year), military personnel, and college students. Virtual services expand Denali’s ability to meet the needs of these and other members. “Providing our online banking service has greatly improved our ability to retain our membership,” O’Connell says.

In addition, the credit union serves many members who live in remote areas and off the road system. Denali’s global network—which encompasses virtual services—is designed to cater to customers, regardless of their geographic location. “You have to be ready for what your member wants to do,” Fernandez says. “It’s the changing nature of business. It’s a different expectation among the consumers.”

For Credit Union 1, offering virtual banking creates an opportunity to provide additional value. The credit union’s members value the ability to receive services that can’t easily be offered in-branch, such as easy access to their credit score and associated analysis, budgeting tools, and virtual savings goals. “Supplementary online services such as these carry a big potential to display content to members that is uniquely relevant to them, as opposed to spamming people with information that doesn’t apply to them or their situation,” Hasbrouck says. “We want to be able to recognize our members’ individual needs and be there for them when they need us.”

Positive Impact

Virtual services are having a positive impact on financial institutions and their customers. For example, at Credit Union 1 efficiencies are gained by having a robust platform that can provide members with extensive information and the ability to perform multiple types of transactions. However, most of these efficiencies, Hasbrouck says, are associated with time-savings rather than cost-savings for the credit union and its members. He explains: “When more people use our mobile app to check their balances, it reduces the number of people who call in for their balances, which reduces wait time in our Member Service Center. When people decide to deposit their check through the app, it reduces in-branch transactions, which means we see fewer people waiting in line. And when members use our Secure Message Center to inquire on their account, it means less people sitting with Member Service Officers—and that translates to a shorter wait time in-branch.”

Credit Union 1 has been seeing year-over-year decreases in branch transactions across its entire system, which Hasbrouck attributes to the expansion and popularity of online and mobile banking. However, there will always be a place for physical branch locations, he says, adding: “While we’re not quite at the point of repositioning personnel, we are using this transitional time to consider what we want our branches to look like in the future and how technology and our employees will play into this.”

Denali State Bank

Golden Heart branch.

Denali State Bank

At Denali, virtual banking services have impacted the credit union’s physical footprint, resulting in a reduction of its branch network. Denali doubled its branch network between 2007 and 2017—going from ten to twenty branches—but did not come close to doubling its transactions. That’s partially because its services can be accessed online. Currently, the bank has fifteen branches.

Certainly, online services increase cost efficiency because they help reduce the footprint and overhead of brick-and-mortar establishments, O’Connell says. But she points out that Denali has not reduced employment opportunities by establishing online services. Instead, the credit union altered where and how team members provide their support. O’Connell says, “We have some team members who work from home, and that reduces the overhead of us having an office building or branch on the corner. We’re shifting costs, and we can take those resources and apply them to other places.”

Online banking is also having a positive effect at Denali State Bank, which has been able to contain personnel costs. “Our overall transaction activity has increased, but our personnel costs have not increased at the same rate,” Lundgren says.

Inherent Challenges

But there are intrinsic challenges to providing services electronically. When customers utilize financial services digitally, it reduces their face time with a banker and makes it more difficult to maintain a personal relationship. That’s an issue to Denali State Bank, which focuses on relationship banking. Lundgren says, “We like to see our customers, and we spend a lot of time and energy focusing on training our staff and supporting a culture of high customer service. It’s hard to have that face-to-face contact if we never get to talk to them if they do everything electronically.”

There are some things that people still generally come into a branch for, such as customer service and problem resolution. “We still see people when they want to open an account with their child or want to set up an automatic transfer and aren’t sure how to do that,” Lundgren says.

Reaching out to members through an online interaction is also a challenge for Denali, Fernandez says. Having a “human connection” helps build trust and loyalty, but building a sense of loyalty in the virtual world requires a different approach. That’s why the credit union is expanding its focus to e-marketing to better connect with members virtually. Denali is incorporating a SMART e-marketing solution to directly market products and services to meet their members’ needs. “We had a basic version of that with an older online system, but I think this new e-marketing system will be a tremendous boon to us,” he says.

“The new [unified user experience] has been a key to us. About three years ago, we had about 29,000 members. Less than three years later, we now have about 41,000.”

—Keith Fernandez

Vice President of Corporate Communications and Development

Denali FCU

Credit Union 1 is concentrating more on social media, among other tactics, to better engage its electronic banking customers. A key part of Credit Union 1’s culture is community involvement and outreach. As such, it’s important for the credit union to be able to highlight its and its members’ activities in the community. But this personal element can sometimes be a challenge when there isn’t as much face-to-face time with members, says Hasbrouck. To minimize this disadvantage, the credit union has elevated its social media presence. “This allows us to connect on a more social level with our members, even when this connection is electronic rather than in-person,” he says. “Credit Union 1 has been repeatedly recognized by The Financial Brand as the ‘most social’ credit union in Alaska—a recognition that we’re proud to maintain as many of our member connections continue to shift to a virtual sphere.”

Regardless of its inherent challenges, virtual banking has been and will continue to be important to consumers and businesses, Lundgren says. He adds: “Our perspective is that those online solutions are here to stay. They are going to continue to grow and evolve.”![]()