ommunity development financial institutions (CDFIs) share a distinct mission: to expand economic opportunities in communities traditionally overlooked by banking and investing services. There are approximately 1,000 certified CDFIs in the United States, and 8 of them operate in Alaska.

The CDFIs in Alaska are Alaska Growth Capital (AGC), Alaska Benteh Capital, Cook Inlet Lending Center (CILC), Haa Yaḵaawu Financial Corporation, NeighborWorks Alaska, HomeOwnership Center, Spruce Root, and Tongass Federal Credit Union (TFCU). These mission-driven, private-sector entities often work together to serve low- and middle-income individuals in urban and rural areas. They promote self-sufficiency, economic growth, and community redevelopment.

Tongass Federal

Credit Union

At CILC, the primary goals are to improve the financial knowledge and wellness of its communities; expand its outreach, products, and services to serve more people; and diversify its funding sources for greater sustainability and opportunities. “As a Native CDFI, CILC vigorously pursues opportunities to financially empower Alaska Native families, businesses, and communities,” says President and CEO Jeff Tickle.

CILC offers a variety of financial products and services to underserved populations, including down payment assistance loans, primary mortgage loans, and down payment assistance grants (Home$tart and Native American Homeowner Initiative) as a member of Federal Home Loan Bank of Des Moines. It also provides micro and small business loans and credit lines, as well as financial wellness services. For 2025, CILC plans to launch a credit builder loan product.

Tongass Federal Credit Union

AGC’s niche and expertise is lending in rural areas and to Native-owned businesses. “Our goal is really to help get our clients to a ‘yes’ on their loan when they have not been able to successfully access financing elsewhere,” says Mary Miner, vice president of community development.

Tongass Federal Credit Union

Spruce Root

Spruce Root has a unique vision: to amplify its Haida, Tlingit, and Tsimshian ancestral imperative to ensure Southeast thrives for future generations. “We are a driver of a regenerative economy across Southeast Alaska, so communities can forge futures grounded in this uniquely Indigenous place,” says Executive Director Alana Peterson.

Spruce Root offers Fast Start Loans—zero-collateral financing up to $50,000 for qualifying borrowers—and standard business loans up to $500,000. Since its inception in 2012, it has deployed more than $4 million in lending capital to establish small businesses in Alaska. “In 2023 alone, ten loans totaling $850,000 were deployed across seven Southeast Alaska communities,” Peterson says.

Managed by the US Treasury Department, the CDFI Fund offers certification to CDFIs, which allows them to apply for financial and technical assistance awards. For example, grant funds enabled TFCU to establish local services in remote villages through community microsites.

During the COVID-19 pandemic, federal funding had a significant impact on CILC. It was able to partner with the Municipality of Anchorage to administer grants to small businesses, nonprofits, and artists totaling more than $30 million.

The CDFI Fund also has the New Markets Tax Credits Program. Begun in 2002, it encourages private-sector investment by offering tax credits for qualified community development investments. In Alaska, AGC is the only entity that receives those credits, according to Miner. The Native Initiatives CDFI Program provides further capital. “The CDFI fund is our largest supporter, and we are grateful for all the resources that it provides,” Miner says.

Tongass Federal Credit Union

Cook Inlet

Lending Center

CILC is part of a small business scaffold in the Anchorage area. “We have a very strategic partnership with the Anchorage Community Land Trust (ACLT) and Cook Inlet Tribal Council around ACLT’s initiative of an Indigenous Peoples Set Up Shop program, in which ACLT provides business training and assistance and CILC provides lending services and capital,” Tickle says. “This partnership with ACLT is a primary reason Cook Inlet Lending now has a Small Business Lending program.”

CILC is also part of a Native CDFI and Friends cohort that shares best practices, challenges and opportunities, and regular updates. It has also engaged in a home lending cohort with Colorado-based Oweesta Corporation and other Native CDFI’s. They have provided CILC with insights into various mortgage financing opportunities, along with technical assistance from the Homeownership Council of America.

Cook Inlet Lending Center

AGC also collaborates with traditional lenders. “All of our loan officers here came from the conventional banks in Alaska, so they have deep connections with those lenders and are regularly meeting with them,” Miner says. “It takes a village to help move some of these big initiatives forward and to help small businesses.”

CILC also plans to measure participation in financial education workshops and its soon-to-be-launched credit builder loan program. It will evaluate how its people are improving their financial literacy and long-term financial health through changes in credit scores, savings, and debt levels being tracked over time.

“We aim to collect client feedback and success stories to help us assess the broader, less tangible benefits of our services,” Tickle says.

A recent funding success story of CILC is Yukon Tails, a mobile pet grooming business in Wasilla. Its owner, Teela Bieschke, identified the need for mobile pet grooming when she was unable to find services for her elderly dog experiencing mobility challenges. After being placed on lengthy waiting lists, she decided to start Yukon Tails. “Cook Inlet Lending Center was thrilled to partner with Teela and Yukon Tails to help launch this exciting new business venture,” Tickle says.

Spruce Root helped long-time client Edith Johnson launch Our Town Catering in Sitka. According to Peterson, Johnson’s journey included Spruce Root from the beginning when she received assistance to establish her LLC. From there, she participated in Spruce Root’s training programs to start her first small business and worked on her personal finances to purchase her first home. By then, she was ready to approach Spruce Root for a loan to purchase her second business. “Her journey exemplifies our missions to empower local talent and support local businesses,” Peterson says. “We feel so fortunate to be witness to the positive impact people like Edith have on our region’s community, culture, and economy.”

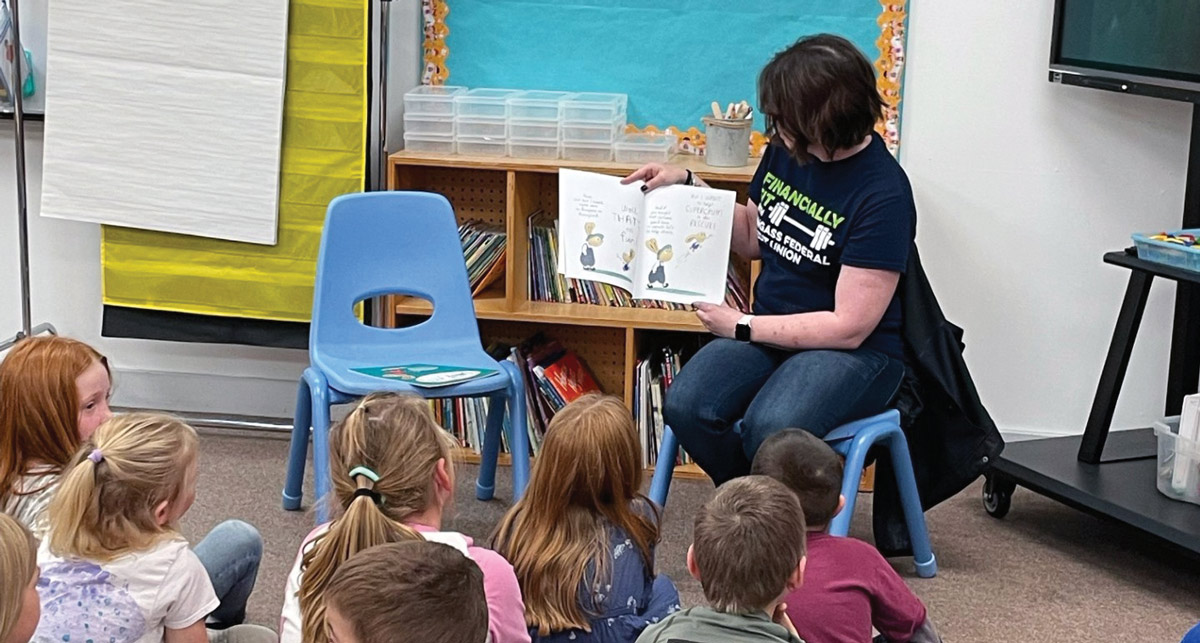

One of TFCU’s proudest success stories is its work with the Metlakatla Indian Community. When the only bank branch on the isolated island closed in 2005, residents were left without access to essential financial services. TFCU stepped in by offering weekly services and, within a few months, opened a branch in the old bank building. “Over the years, we’ve introduced a range of services from home equity loans to financial education in local schools,” Mickel says. “Today, 85 percent of the community are Tongass FCU members, and the median credit score has risen by seventy-four points, reflecting the positive impact of our services.”

TFCU is committed to continuing its efforts to strengthen the economic resilience of Southeast, Mickel says. The credit union recently hired additional staff to support the growing team at its main office in Ketchikan, which oversees all its other locations. It’s also planning to build a larger office in Ketchikan to accommodate this expansion. Additionally, TFCU is expanding its financial education programs and introducing new financial products like Lifestyle Loans to meet the evolving needs of its members. Mickel says, “These initiatives, along with continued partnerships with local organizations, will help us provide the financial tools and resources that our communities need to thrive.”