Alaska Trends

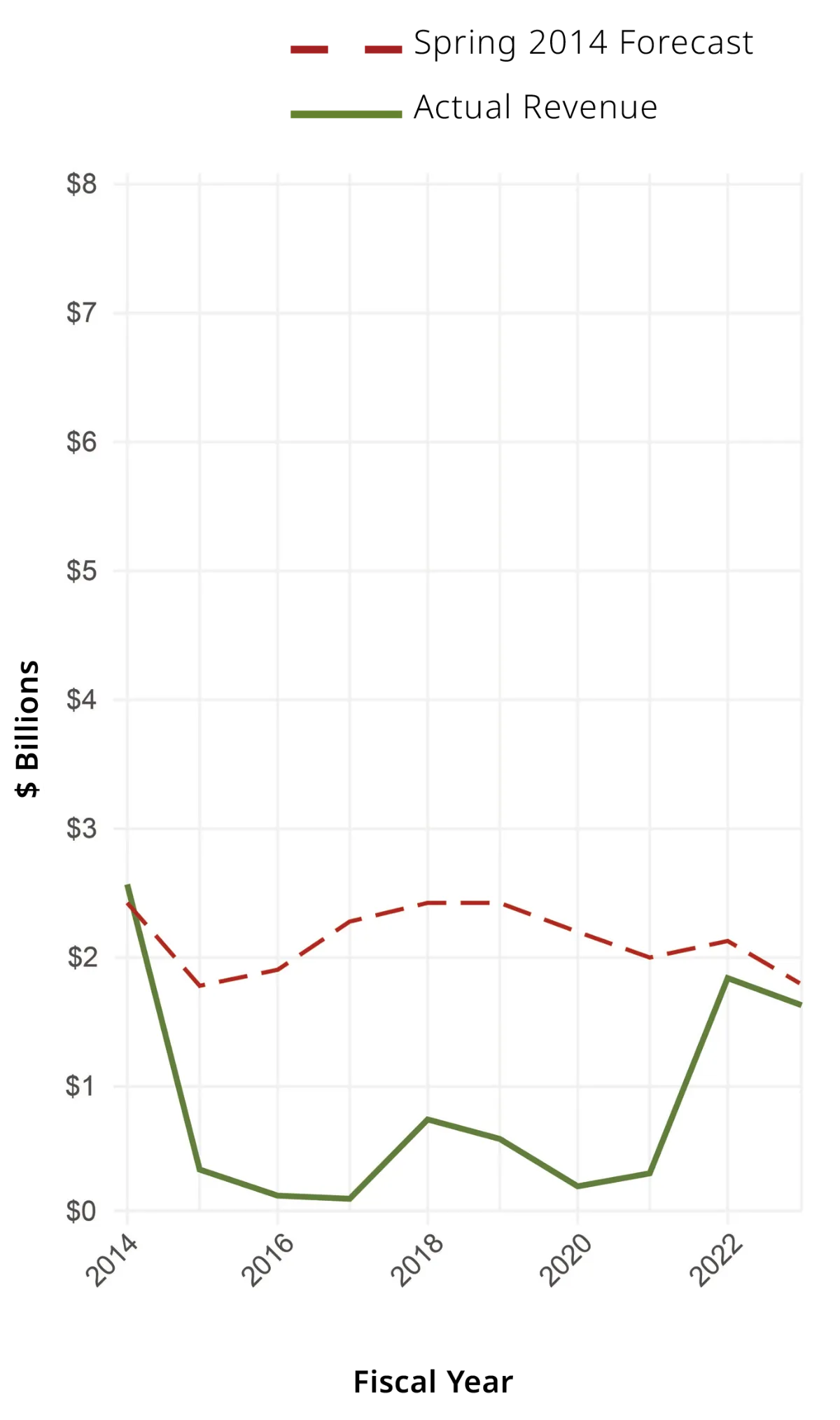

ike clockwork, the Alaska Department of Revenue publishes its report and forecast on the state’s income sources twice a year, in spring and fall. Data in these reports are the public’s most essential indicators of the state government’s fiscal health. Because of the vast reliance on petroleum revenue, the upshot of the forecast is how much tax the State of Alaska expects to collect at a given oil price and production volume. The department is preparing the latest edition this month, in advance of the next legislative session.

The public policy aspect of the oil and gas industry is generally outside the purview of Alaska Business, but the decennial check-in with the tax regime established by Senate Bill 21 in 2013 (and upheld by voters in 2014) affords an opportunity to examine this interface between government and industry.

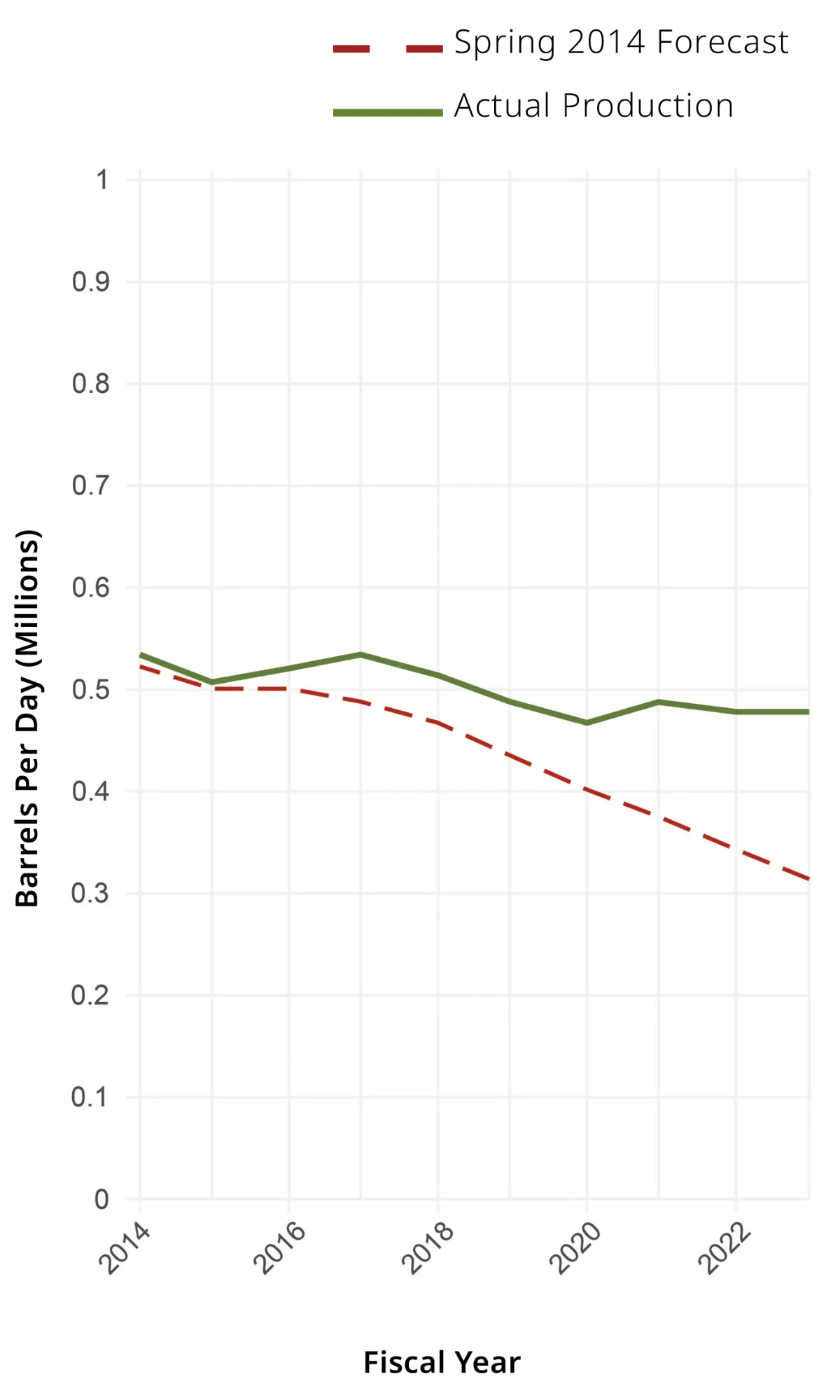

At the annual Alaska Oil & Gas Association conference in August, Revenue Commissioner Adam Crum presented a slideshow called “A Decade of Stable Oil Production.” The title served as a reminder that the tooth-and-nail battles over oil taxation that grabbed so much attention in Alaska political circles starting in 2002, when global oil prices surged, had calmed to a background hum after the price retreat in 2014. The last decade has been comparatively quiet. The “dog that didn’t bark” has been easy to ignore.

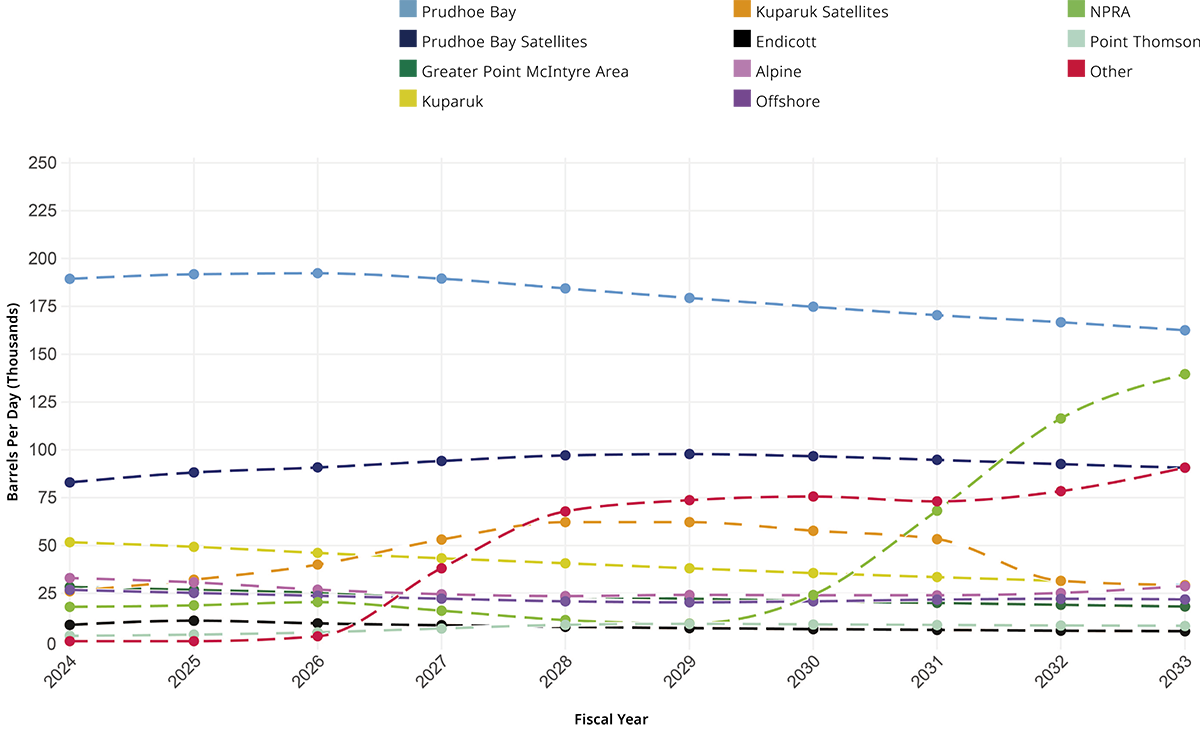

Crum’s presentation relied on the spring 2024 forecast, the most current available at press time. This edition of Alaska Trends illustrates production and taxation from the last decade and projecting for the next, as revenue declines while new production comes from federal lands with a smaller cut for the state. Fill ‘er up with fiscal facts!

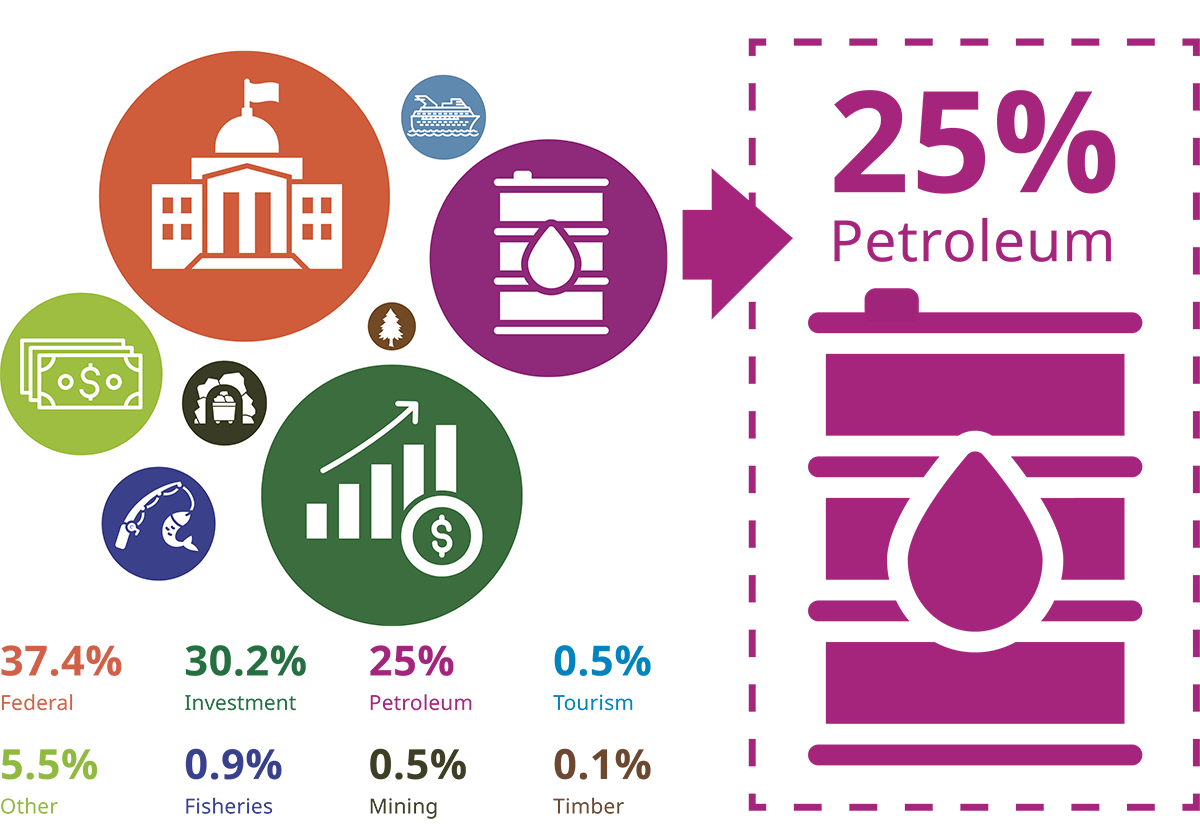

Total State Revenues, FY2023

Projected 2024 – 2033